New Tax Regime for Salaried Individuals – FY 2025-26

Why Tax Planning for FY 2025-26 Is Critical

The Income-tax framework for salaried individuals has undergone a significant transformation for Financial Year 2025-26. The New Tax Regime has been strengthened to encourage voluntary compliance, reduce documentation burden, and allow a larger segment of salaried employees to achieve legally optimised or even **nil tax liability**.

A timely review before **31st March 2026** is essential to ensure correct regime selection, maximum benefit utilisation, and prevention of avoidable tax payments.

Understanding the New Tax Regime – Section 115BAC

Section 115BAC introduces a simplified taxation mechanism where taxpayers may choose lower slab rates in exchange for forgoing most traditional deductions and exemptions. It is now treated as the **default taxation option** while filing income-tax returns, unless the taxpayer specifically opts for the Old Regime.

The New Regime significantly reduces compliance risk, documentation requirements, and audit exposure for salaried professionals.

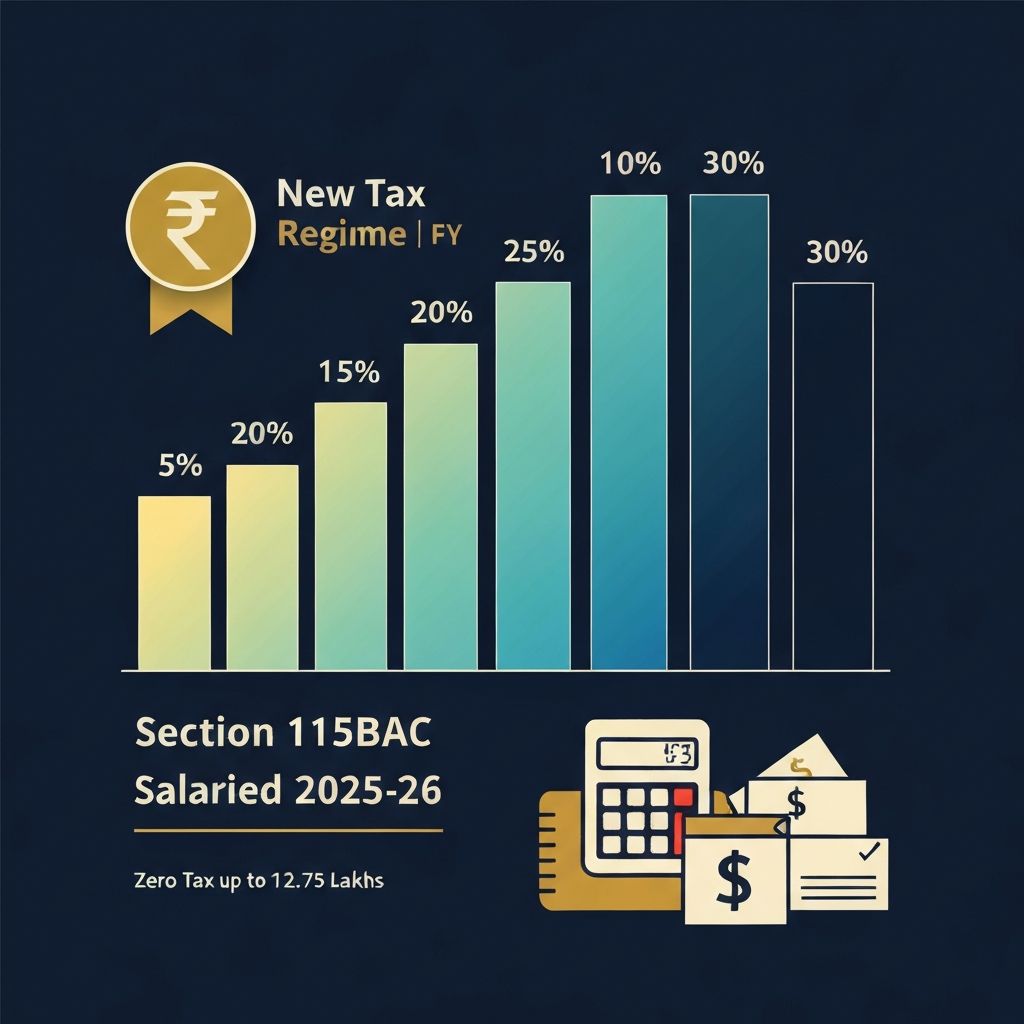

New Tax Regime Slab Rates – FY 2025-26

| Total Taxable Income | Applicable Tax Rate |

|---------------------|---------------------|

| Up to ₹4,00,000 | **Nil** |

| ₹4,00,001 – ₹8,00,000 | **5%** |

| ₹8,00,001 – ₹12,00,000 | **10%** |

| ₹12,00,001 – ₹16,00,000 | **15%** |

| ₹16,00,001 – ₹20,00,000 | **20%** |

| ₹20,00,001 – ₹24,00,000 | **25%** |

| Above ₹24,00,000 | **30%** |

Standard Deduction – Section 16

Salaried employees and pensioners are eligible for a flat standard deduction of **₹75,000** under the New Regime. This deduction is automatically applied while computing taxable salary and does not require any supporting documentation.

This provision alone substantially lowers tax exposure for salaried individuals.

Zero Tax Benefit – Section 87A Rebate

Resident individuals whose total taxable income does not exceed **₹12,00,000** are eligible for rebate under Section 87A. When combined with the ₹75,000 standard deduction, a salaried employee earning up to approximately **₹12.75 lakh gross salary** can enjoy **zero income-tax liability**, subject to certain income composition conditions.

Who Should Prefer the New Tax Regime

The New Regime is particularly beneficial for individuals who:

When the Old Regime May Be More Beneficial

Taxpayers with significant deductions such as PPF, LIC, ELSS, medical insurance, HRA, home-loan interest, and donations may achieve lower tax liability under the Old Regime.

A comparative analysis is strongly recommended before finalising the regime choice.

Year-End Compliance Checklist (Before 31-03-2026)

Need Expert Guidance?

Still unsure which regime works best for your situation? I can help you with a detailed comparison based on your specific salary structure and deductions. Contact me today for personalized tax planning advice.

Found this helpful? Share it with others!

Need personalized tax advice?

Every situation is unique. Let's discuss your specific case and find the best tax-saving strategies for you.

Chat on WhatsApp